Processing History for Stripe, Square, and PayPal

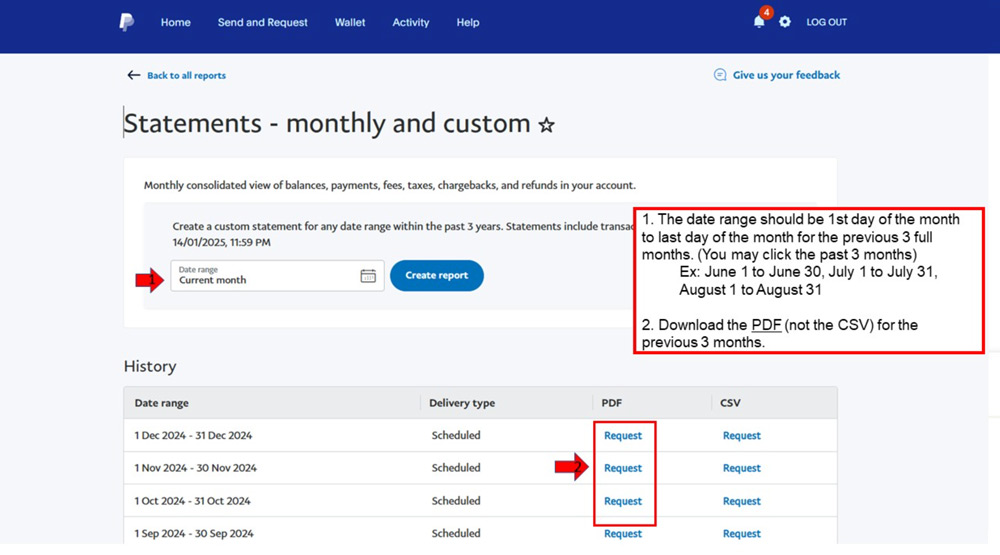

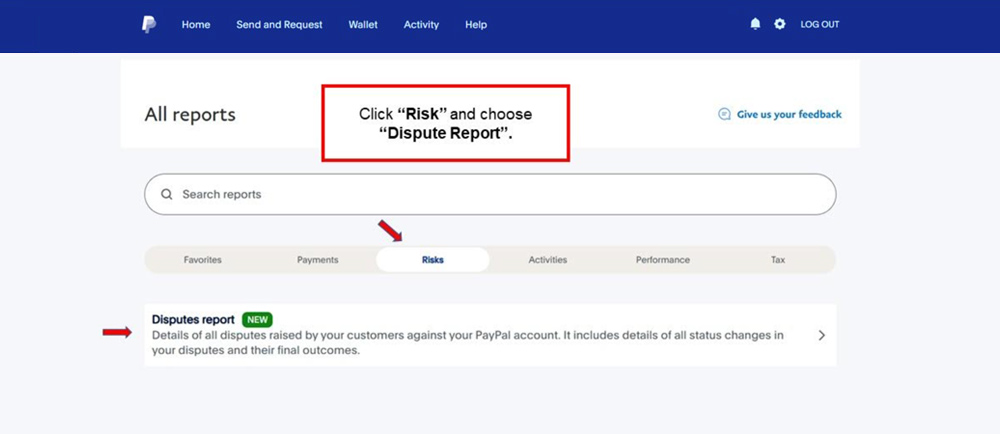

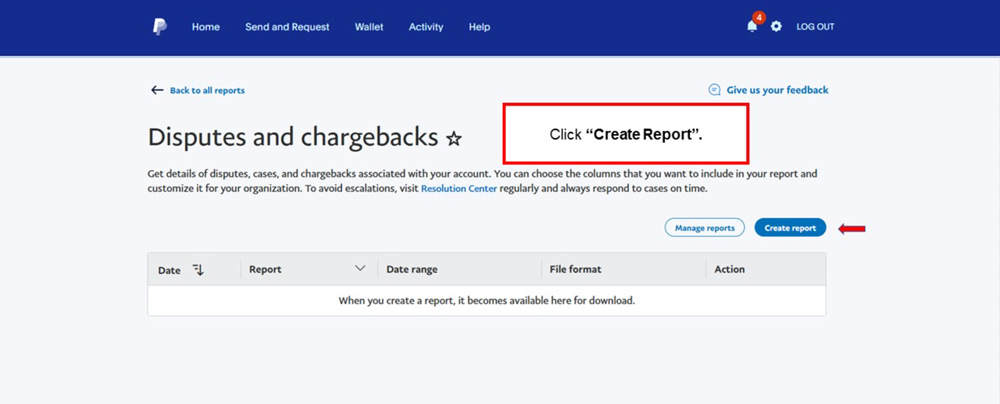

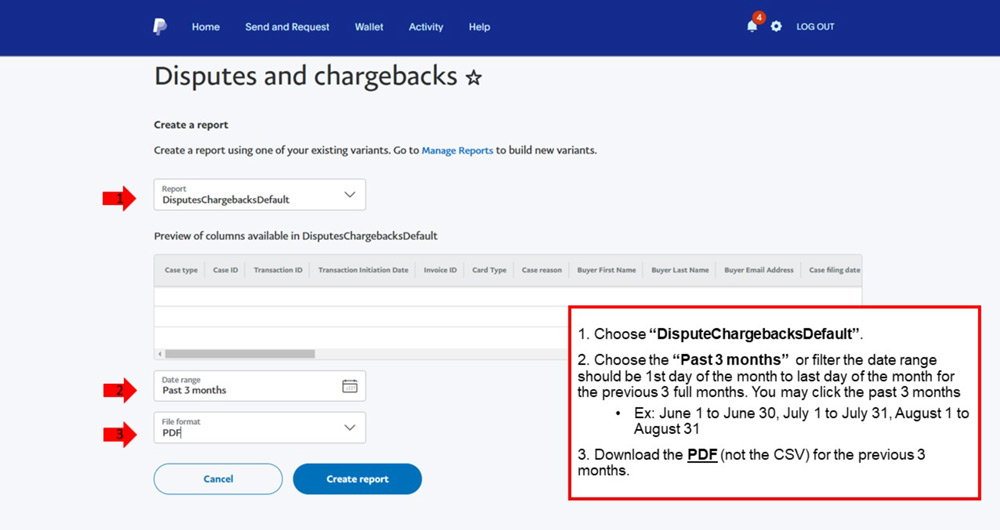

For merchants who have processed credit card payments in the past, the underwriters will require monthly statements from each processor in order to underwrite and approve a merchant’s application.

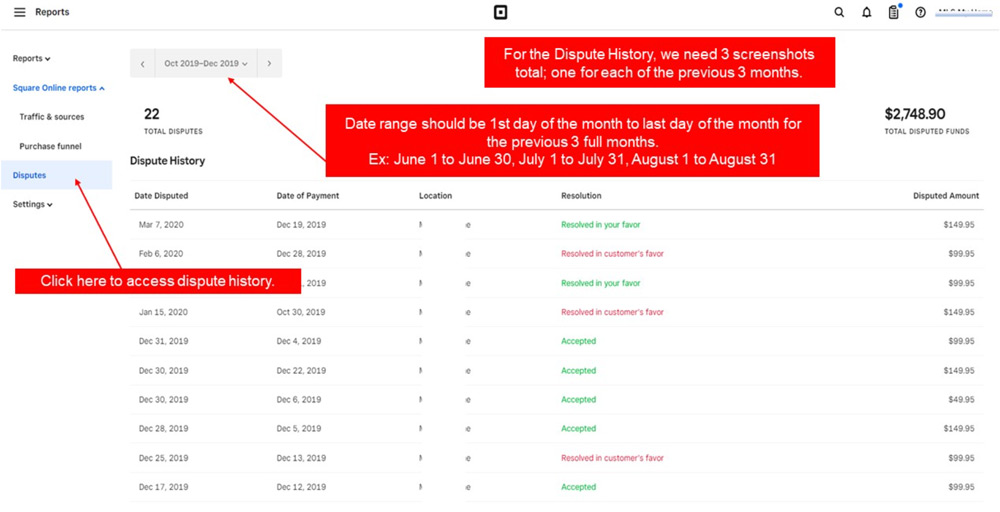

Underwriters need to review the processing history to get a clear idea of chargeback issues a merchant may have had in the past. The underwriter will compare the total number of chargebacks to the total number of transactions to determine your chargeback ratio, and thus determine the risk level associated with your account.

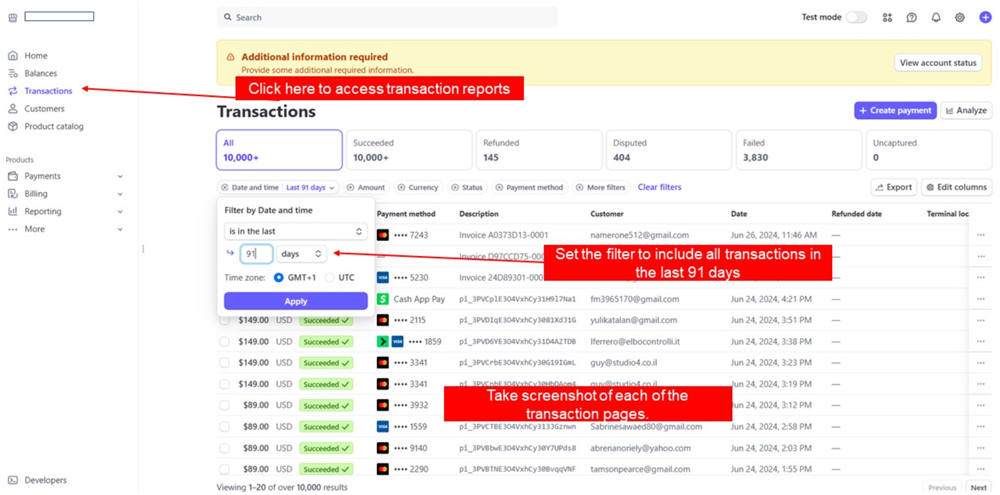

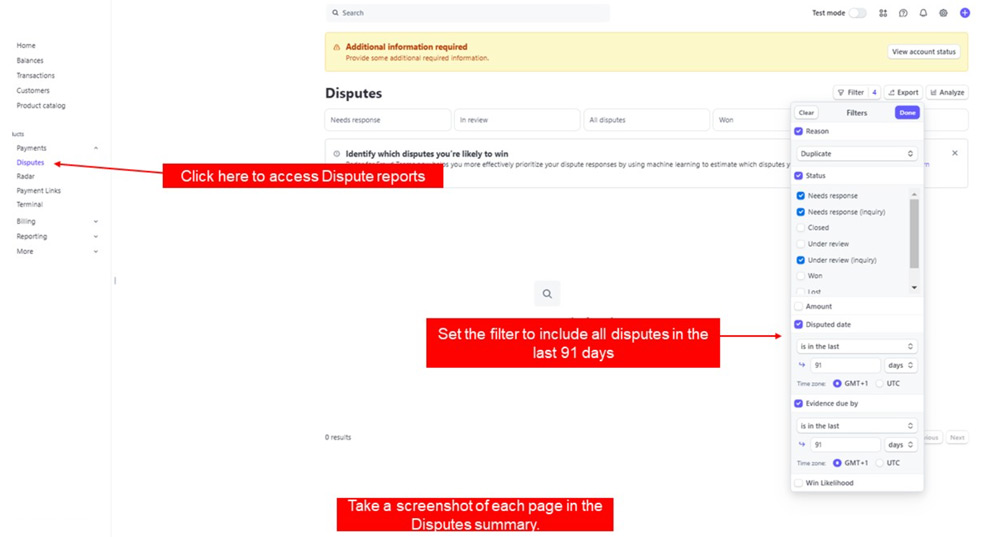

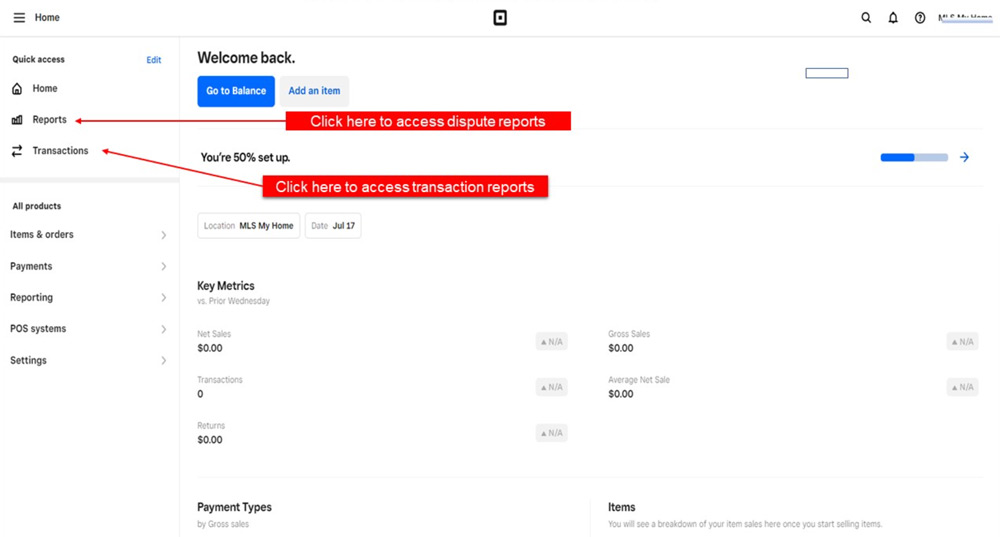

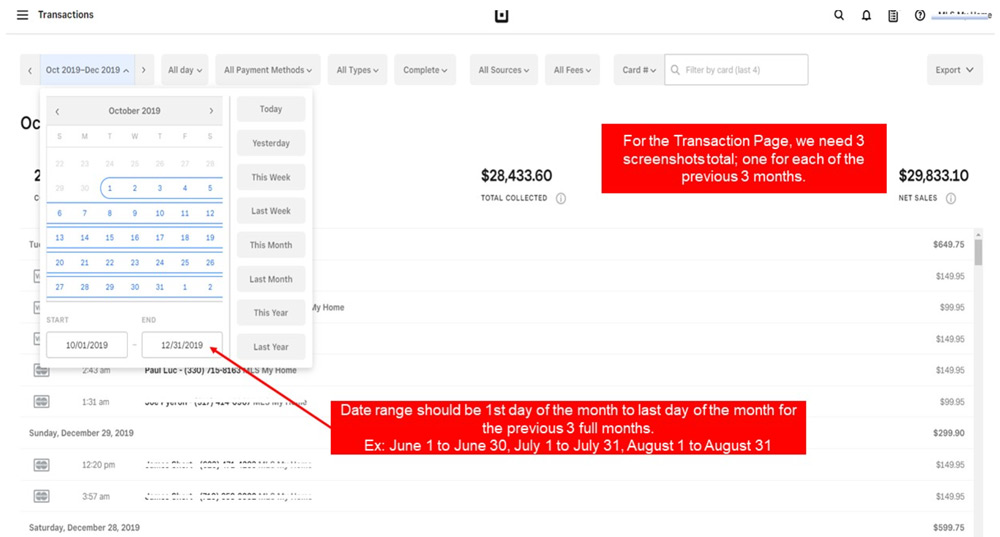

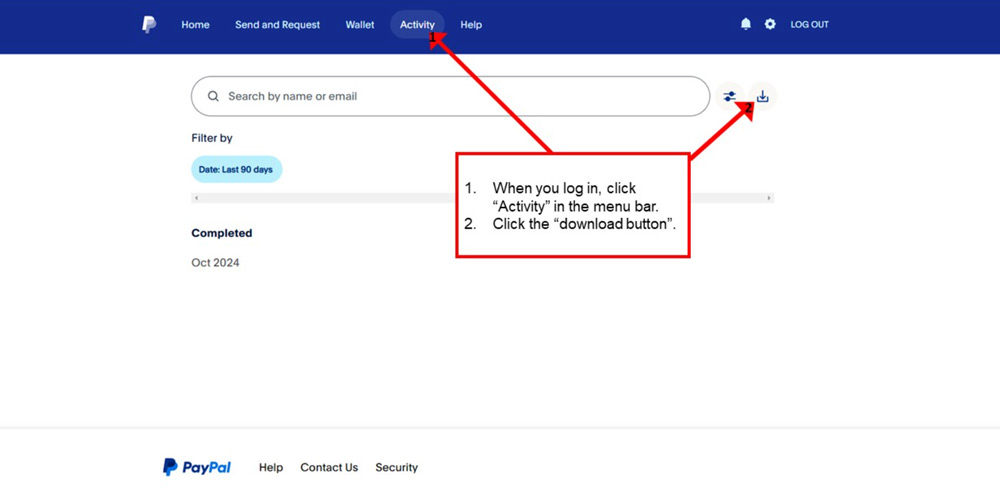

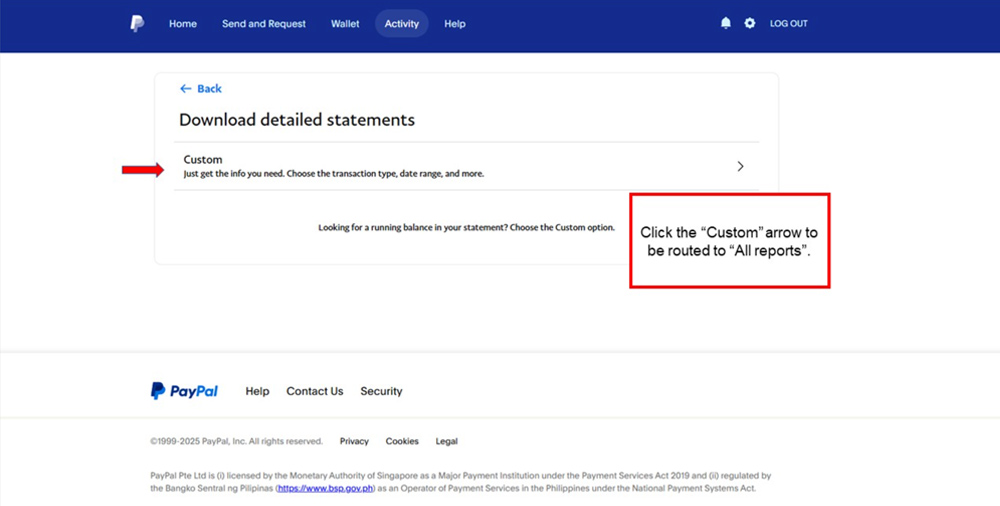

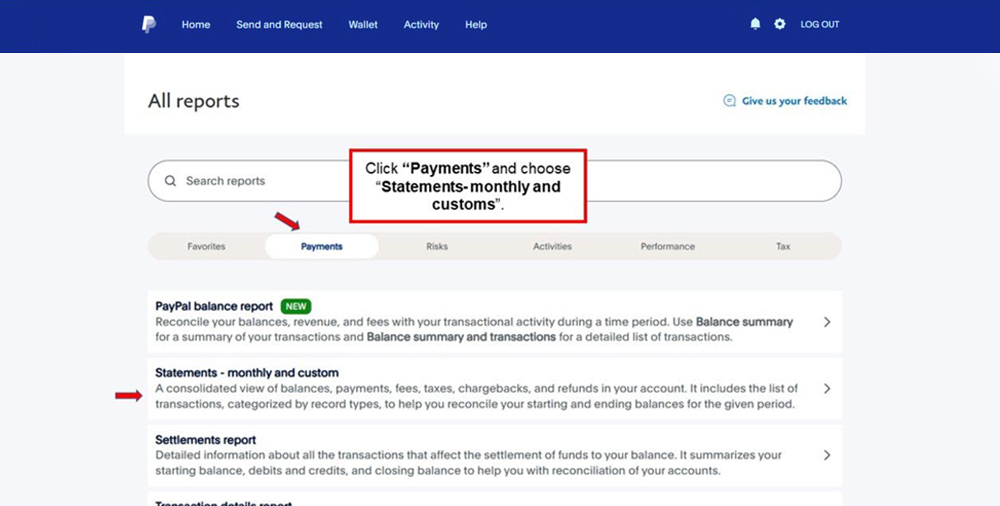

Most processors provide merchant statements which show transaction and chargeback data per month; for those merchant processors that do not provide monthly statements with this data, screenshots from the processor’s dashboard can be a sufficient alternative.

Stripe Screenshot Instructions

Square Screenshot Instructions

PayPal Statement Download

Diverse Payment Processing is Smart Processing

Fill out our free and quick merchant account application and let us match you with many banks that want your business.