EMV 3DS

The PayDiverse Walkthrough

Card-Not-Present (CNP) Transactions

You’re probably familiar with the usual debit card process. You swipe the card, input the PIN and get approval for the transaction. Modern commerce is increasingly hands-off, however, and more customers than ever before are choosing to use card-not-present (CNP) transactions. If your business offers in-person point-of-sale as an option, then you’re either already seeing this or soon will be.

The most common type of in-person CNP transaction is done with a smartphone. Apple Pay is an example of this, where people just wave their phones over the pay station to authorize the transaction. Unfortunately, as the speed and convenience of a transaction increases, so does the opportunity for fraud. A special layer of security is needed to make these exchanges fast and confident, and to protect you as a retailer from identity theft and other kinds of criminal activity.

EMV 3DS Processing Solutions

What Are the Features of EMV 3DS?

The EMV 3DS solution is engineered to achieve three major goals:

1

Increase Sales Volume With More Approvals

Every wrongly declined sale is a missed opportunity for the seller. If you have a customer with a damaged or expired card, or just a card that’s been demagnetized by accident, you could have a frustrated customer abandon the sale after being declined. Damaged chips, lost cards, malfunctioning terminals and human error all factor into losing otherwise good sales. The EMV 3DS process tends to approve more sales in total, since it largely eliminates these errors, resulting in more sales volume, faster processing to approval and a more productive sales floor.

2

Improve the User Experience

A lot of sales processes are very user-unfriendly. It’s one thing to remember a PIN you set when you opened a bank account 10 years ago, since that’s usually a four-digit number, but do you remember all of your passwords online? When you make a payment by phone, do you know your entire 16-digit card number offhand, or do you need to go get your wallet? What about the zip code you had when you got the card, but have since moved and have to look up again?The EMV 3DS approach harmonizes all of this identity checking and verification into a single streamlined process that’s far easier on customers. With a current e-commerce cart abandonment rate hovering around 70%, in part because checking out can be a real hassle, retailers need all the help they can get in simplifying the CNP sale process.

3

Fight Fraud

Chargebacks cost merchants money, though this is changing with EMV 3DS. Traditionally, the merchant has had the burden of preventing identity-based fraud at the point of sale. Liability for disputed transactions sat with what were sometimes very small retailers that couldn’t afford the expense. Once a 3DS authentication has been run, however, the burden often shifts to the card issuer, which lifts a load off of the seller and encourages faster, safer transactions.

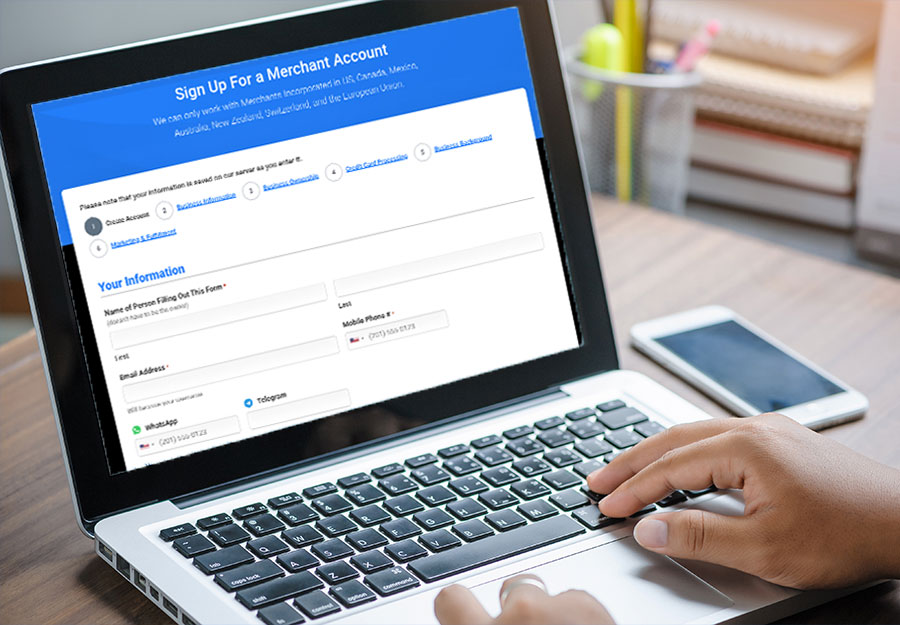

How to Apply for an EMV 3DS Account With PayDiverse

It’s easy to get started accepting CNP transactions with PayDiverse. For most retailers, it’s a three-step process:

- Apply online using our secure application form.

- Digitally sign your applications.

- Electronically submit your supporting documents.

Improve the Likelihood of Approval

PayDiverse tries to approve as many applications as possible in a timely manner. You can make your own application process easier and more likely to end with an approval by getting your business in shape before submitting your documents. In particular, make sure that:

- All of your business bills are paid on time

- Your business bank balances are positive and as high as you can reasonably keep them

- Complete, accurate and truthful information is submitted on your application

- Your business has a track record of competency and professionalism

Diverse Payment Processing is Smart Processing

Fill out our free and quick merchant account application and let us match you with many banks that want your business.