Dual Pricing Program

Dual Pricing Program

Offering the option to pay by credit card is vital for retailers that want to succeed in almost any marketplace. Today’s consumers usually don’t carry spending cash, and credit is often their only payment option. If you don’t get with the times and offer your customers a convenient way to pay, it goes without saying that you can expect a considerable drop in your overall revenue.

While offering credit card payments is an important way to make sales, the tools and services required to do so are expensive. Most businesses lose anywhere from 2 to 4% of their sales revenue on every credit card transaction. With dual pricing programs, you’re able to pass that expense on to your customer.

If you’re a small business owner with a limited budget, or simply a business owner looking to cut costs, PayDiverse’s dual pricing program can help. This program offers an affordable option for merchants to expand their payment options without breaking the bank.

What is a Dual Pricing Program?

Across the globe, businesses are adopting dual pricing programs in their stores, restaurants, shops and offices. These programs offer you the opportunity to accept credit card payments while enjoying the benefits of zero fee processing. With dual pricing, you absorb the cost of credit card processing into the price of goods or services, ultimately passing your surcharge expenses to your customers. When a customer chooses to pay with cash, you offer them a discount of the same amount.

When a Customer Pays With Cash

When a customer chooses to pay with cash, you offer them a discount as a reward for not using their credit card. This discount should be the same amount as your surcharge fees. For example, if you pay 4% for each credit card transaction, the customer should receive a 4% discount on their purchase.

When a Customer Pays With Their Credit Card

If you’re offering a dual pricing program, the customers who choose to pay by credit card are paying your surcharge for you. However, with dual pricing, this charge is already included in the price of goods and services, which means the customer isn’t likely to notice the additional charge and no further action is required at the register.

Dual Pricing vs. Surcharging

Instead of offering dual pricing, you may prefer the simplicity of surcharging. While dual pricing means that you’re offering a price reduction to those who pay with cash, surcharging means adding the surcharge fee to credit card transactions at the register. While both methods work out the same financially, surcharging is a practice that isn’t technically legal in some states and is often frowned upon by credit card providers. It’s important to consider these factors before adopting the practice of surcharging.

Splitting the Surcharge

You may prefer to offer your customers a reduced surcharge instead of passing the entire charge on to the customer. In this case, you can choose to absorb part of the fee yourself while passing a partial surcharge onto the customer via dual pricing.

For example, if you’re subject to a 4% processing fee, you may choose to pass 2% of that charge onto the customer while the other 2% is your responsibility to pay to your merchant services provider.

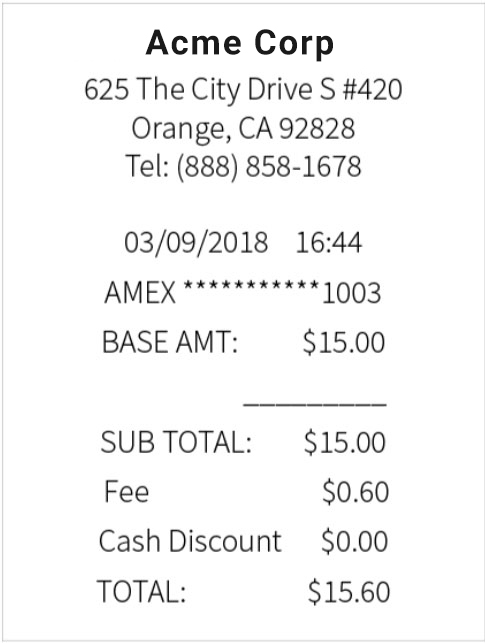

Normal Credit Card Transaction Receipt

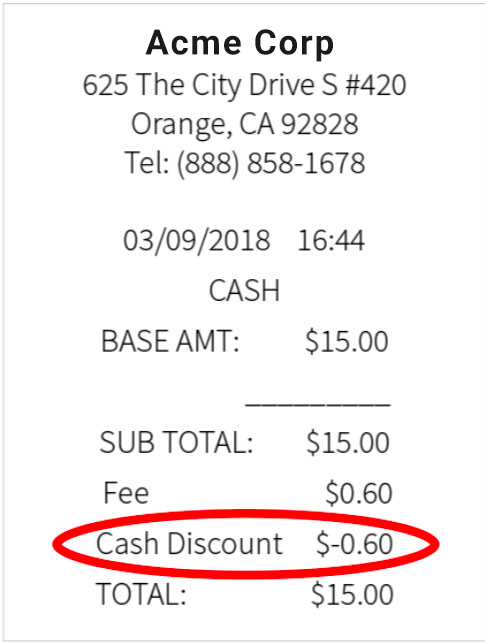

Receipt with Dual Pricing Applied

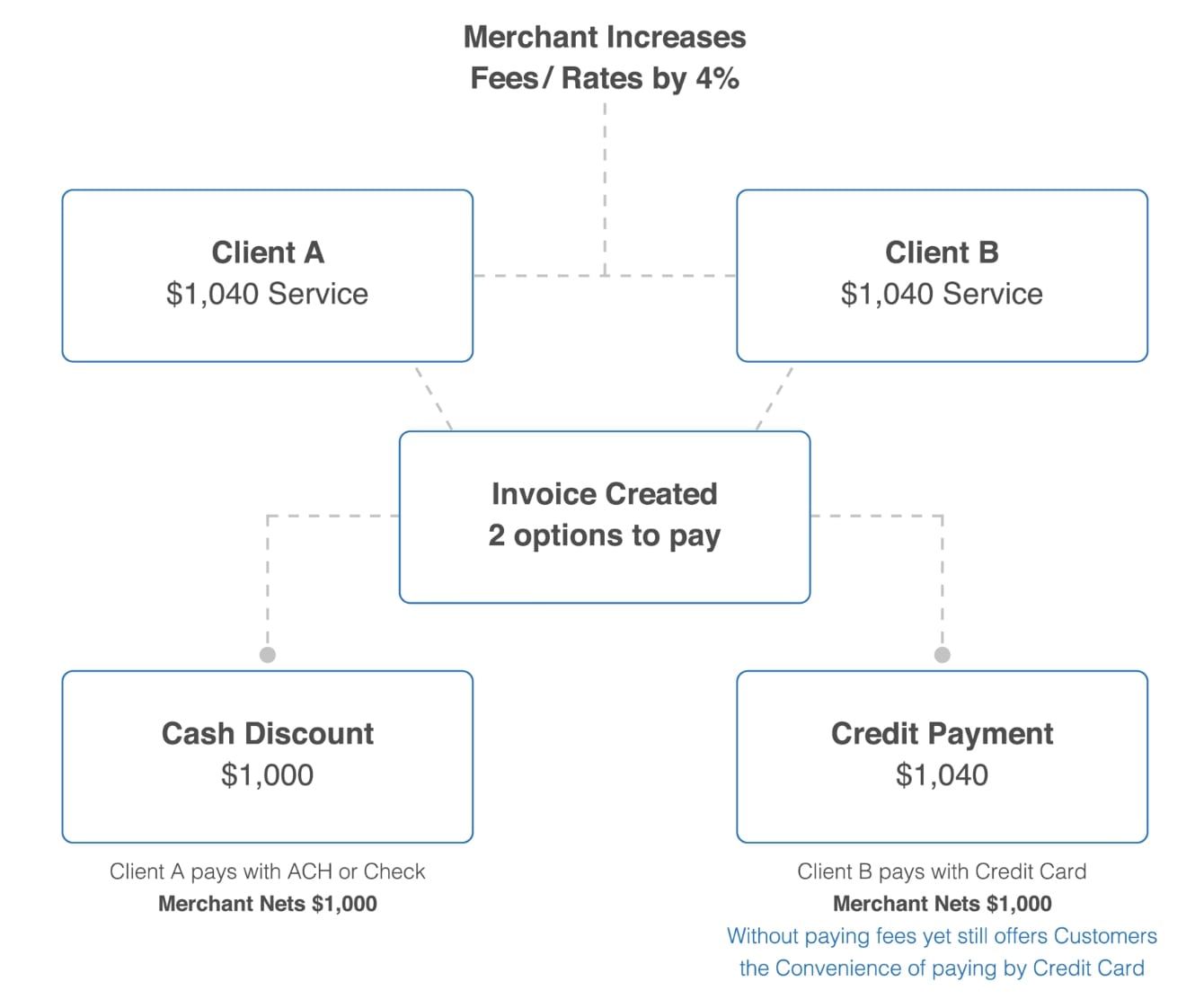

Dual Pricing Flowchart

*In this scenario if Merchant paid the fees in the traditional fashion they would NET: $1000-$40= $960

Other Benefits of Processing With PayDiverse

PayDiverse offers payment processing solutions for merchants in every industry, including those that have been deemed high-risk due to processing habits, industry or even credit histories. We maintain one of the highest approval rates in the industry for new merchants and offer quick decisions on all applications.

We offer a broad range of benefits for our merchants to help them succeed and ensure they can process with minimal downtime and ultimately, increase revenue. In addition to optional dual pricing, benefits of processing with PayDiverse include:

- Payouts in 24 to 48 hours

- Competitive processing rates

- ACH and e-check processing

- Pinless debit capabilities

- Real-time chargeback alerts

- Chargeback support

- Built-in fraud protection

- Offshore processing for high risk merchants

PayDiverse offers processing solutions for mobile, ecommerce, virtual terminal and brick-and-mortar retail locations.

FAQs About Dual Pricing Programs

Is Dual Pricing Legal?

Dual Pricing is completely legal. At PayDiverse, we encourage our merchants to offer dual pricing as opposed to advertising surcharges. Using this method for passing fees to the consumer ensures that merchants can enjoy the benefits of zero fee processing while remaining compliant with laws in all 50 states.

Is Surcharging Legal?

Do Credit Card Providers Allow Dual Pricing?

How Much Does Credit Card Processing Cost?

Processing fees vary depending on the merchant and their processing volume but in most cases, merchants can expect to pay between 2 and 4% of every transaction. A variety of other factors can go into determining this rate, including the card provider and type.

Additionally, card-present transactions, or those processed in-person, are usually subject to a different fee structure than online or mobile payments.

Are Debit Cards Subject to the Same Fees as Credit Cards?

Debit cards, as well as prepaid credit cards, aren’t subject to any surcharges or customer service fees and therefore, aren’t eligible for dual pricing programs. That being said, there are fees in place for processing debit and prepaid card transactions.

Get Started With PayDiverse’s Dual Pricing Program

Dual pricing is available to all merchants who process payments with PayDiverse. When combined with our already-low processing fees, retailers can save big by taking advantage of our dual pricing program. Applying for a PayDiverse merchant account can be done in three simple steps:

2

Digitally sign and submit your application

3

Electronically submit your supporting documents

After we’ve received your application and accompanying documents, our team will verify the information you’ve provided and determine your eligibility. For the best chance at approval, make sure to apply when your balances are high and your bill payments are up-to-date. Additionally, make sure to provide honest, accurate information on your application form.

Upon approval, you’ll be given the option to enroll in our dual pricing program and have the opportunity to take advantage of all the other great features offered by PayDiverse. We can have you up and running within just a couple of days, meaning you’ll be on your way to accepting payments and saving on credit card surcharges in no time.

or call us at