What’s the Difference Between an Acquiring Bank and an Issuing Bank?

- Acquiring Bank: An acquiring bank is a bank that provides merchant services. It enables payment processing for businesses and facilitates the merchant’s end of the transaction when a customer makes a purchase.

- Issuing Bank: Issuing banks serve consumers by providing them with credit or debit cards.

In this article, we explain how these two types of banks work together to move money from point A to point B, ensuring customers are accurately charged for their purchases and merchants receive money for their goods or services in a timely manner.

Understanding the Role of an Acquiring Bank

Acquiring banks, or acquirers as they’re often known in the payments industry, work on behalf of merchants by acquiring funds from customers’ banks when a transaction is processed. Once funds are received, the acquirer deposits the funds into the merchant’s bank account.

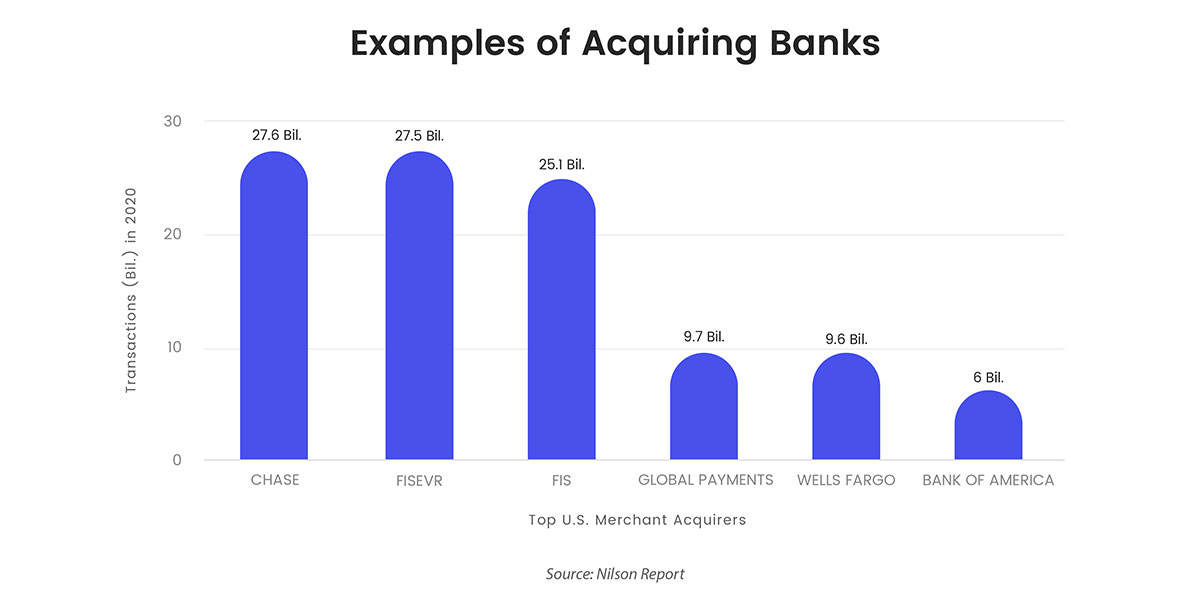

Some of the more well-known acquiring banks in the U.S. include Chase, Global Payments, Wells Fargo and Bank of America.

The acquiring bank handles the following tasks:

- Merchant account regulation and maintenance

- Tracking merchant account activities

- Forwarding authorization requests

- Depositing proceeds from a sale into the merchant account

- Providing the software and hardware that makes payment processing possible for merchants

- Overseeing and reviewing chargebacks on behalf of merchants

Understanding the Role of an Issuing Bank

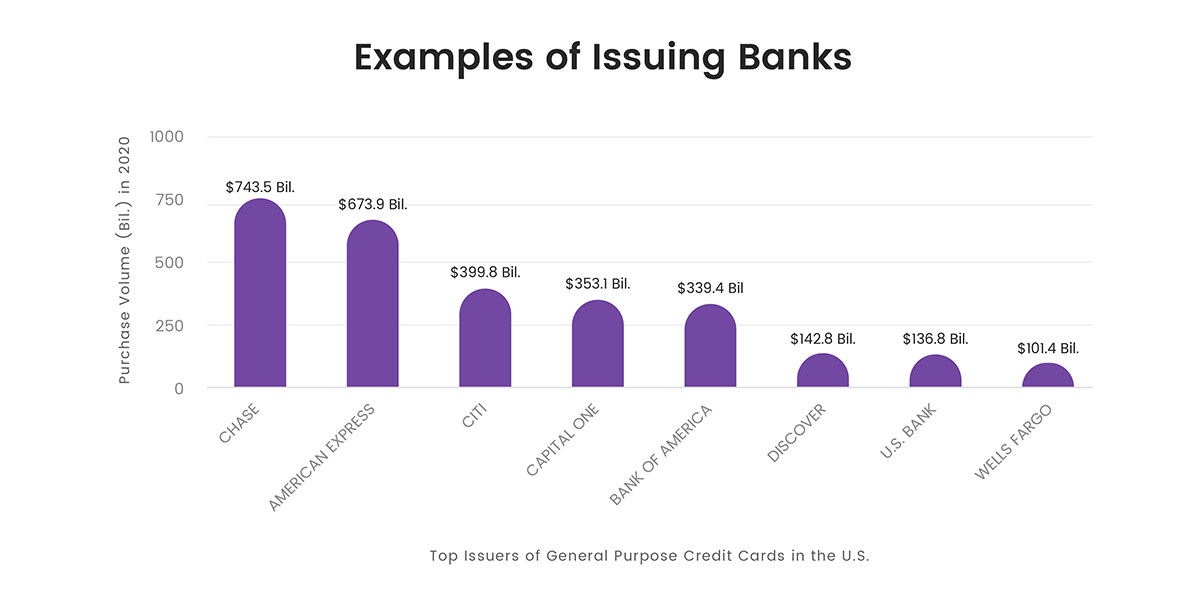

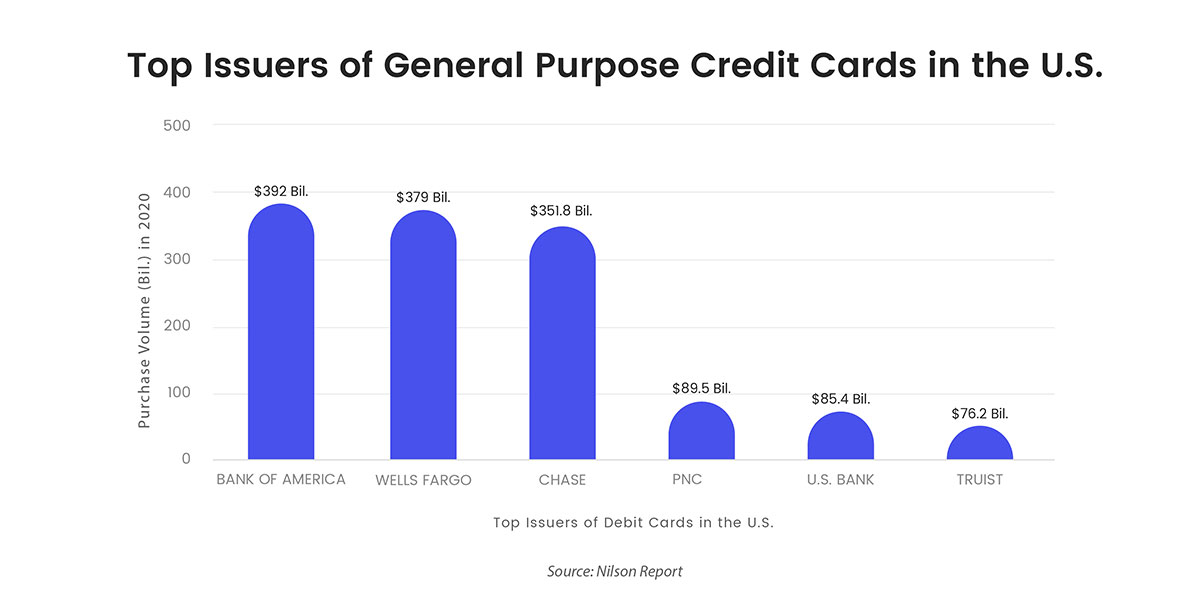

Issuing banks hold consumer funds or issue credit that consumers can use to purchase goods and services. They issue debit and credit cards that can be used to pay for goods. While brands like Visa and Mastercard are generally associated with issuing banks, they’re actually just the companies that facilitate credit transactions. Instead, issuing banks are considered the ones that actually issue physical cards to clients. These include Wells Fargo, Capital One, Bank of America and Chase.

- Reviewing and approving or declining credit applications

- Maintaining consumer credit and debit accounts

- Issuing payment cards to authorized persons

- Approving or declining cardholder transactions

- Releasing approved funds to acquiring banks

- Initiating chargebacks when requested by a cardholder

- Reviewing chargeback responses and determining where liability lies

How a Transaction Works

When a cardholder uses their credit or debit card to pay for goods or services, there are several steps that the transaction goes through before you, the merchant, receive funds.

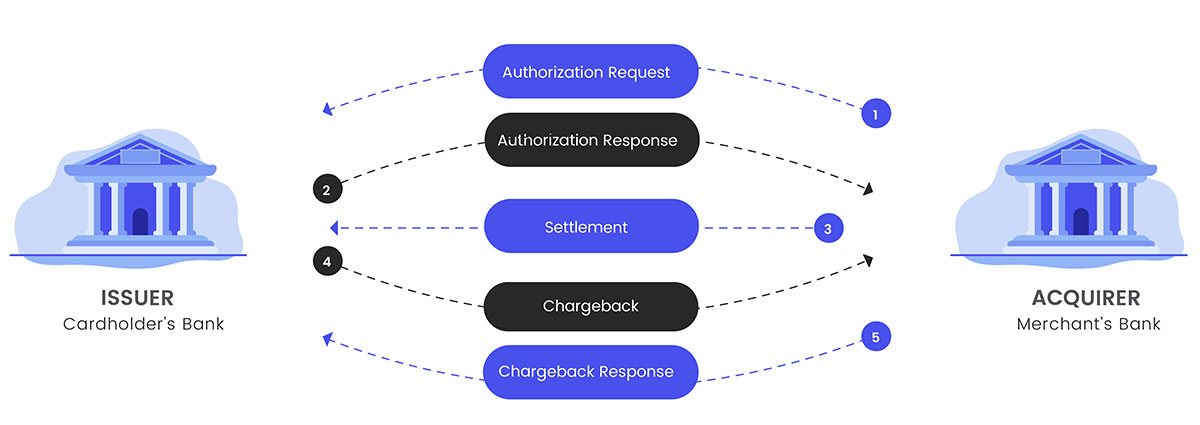

- Step One: Your customer provides their card information and confirms their purchase, which initiates an authorization request. This request is sent from the acquiring bank to the issuing bank.

- Step Two: The issuing bank determines if the cardholder has enough funds to cover the transaction total and confirms the validity of the card. It then issues a response back to the acquiring bank. An approval is issued when the customer has enough funds and the card hasn’t been reported lost or stolen. There are several reasons a card may be declined but most often, it’s due to insufficient funds, a lost or stolen card or a technical issue that occurred during the transaction.

- Step Three: Once both the acquiring and issuing bank have confirmed approval, the transaction is settled, which means funds are moved from one account to the next. In most cases, this process is done at the end of the business day but merchants may prefer to settle their transactions on a different schedule.

How Chargebacks Are Handled

Unfortunately, there are instances when a credit card transaction is processed either inaccurately or without proper authorization. In these cases, customers have the option to request a chargeback on their payment card. The steps involved in a chargeback are as follows:

- Step One: A cardholder contacts their issuing bank to dispute a charge. The process typically requires the cardholder to provide the date and amount of the transaction, as well as a valid reason for the dispute.

- Step Two: The issuing bank forwards the chargeback to the acquiring bank, which then debits the merchant account for the disputed amount.

- Step Three: If the merchant determines the chargeback to be invalid, either because it was requested after the deadline or because the transaction was authorized, they can submit a chargeback rebuttal and submit it to the acquiring bank. This response is then forwarded to the issuing bank which makes a final decision in the case.

Frequently Asked Questions About Issuing and Acquiring Banks

The payments industry is complicated and even for merchants with broad experience, it can be confusing to understand the roles of each party in facilitating transactions. Below are some of the most commonly asked questions about issuing and acquiring banks .

Are Mastercard and Visa considered issuing banks?

Mastercard and Visa are not issuing banks. Instead, they’re considered card brands. However, American Express and Discover, which are also card brands, do sometimes qualify as issuing banks as they issue their own cards, in some cases.

Does every merchant need an acquiring bank?

Merchant accounts are required to store funds from credit and debit transactions; therefore, an acquiring bank is a necessary part of business unless you operate on a cash-only basis.

Which acquiring bank is the best?

There are plenty of acquiring banks out there and it can be difficult to determine which one is the best fit. Before selecting the one with the least expensive fees or the best services, take time to research merchant reviews online and contractual agreements offered by the acquiring banks you’re considering. Additionally, ensure the services being offered are services you need as a business owner and that the cost is competitive when compared with other options.

Do Square, PayPal and other online solutions work as acquiring banks?

While these merchant service providers don’t offer the customized solutions that a typical acquiring bank does, they can be a convenient solution for e-commerce merchants in search of an affordable and basic payment processing option.

Diverse Payment Processing is Smart Processing

Fill out our free and quick merchant account application and let us match you with many banks that want your business.