Stay Ahead of Chargebacks

Updated November 2025 — Visa’s VAMP fraud ratio enforcement is now active (1.5%). Next threshold update expected April 1 2026 (0.9%).

What is VAMP?

Visa’s VAMP (Visa Acquirer Monitoring Program) is a new fraud monitoring system that flags merchants with excessive fraud—especially friendly fraud.

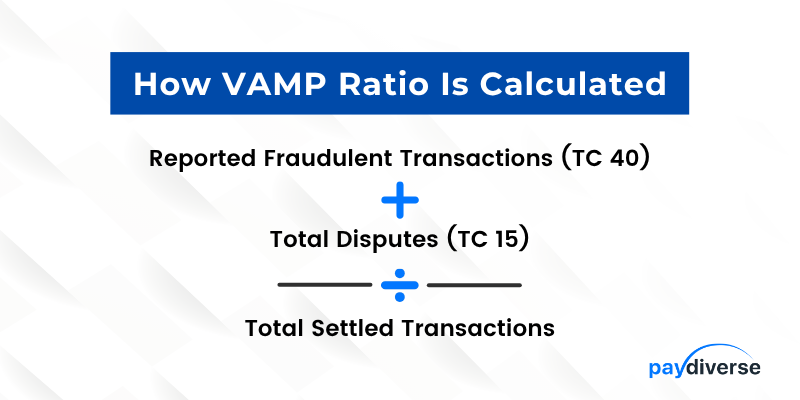

Previously, only chargebacks were tracked. Now, Visa combines chargebacks (TC15s) and fraud reports (TC40s) into a single fraud ratio that processors and banks use to monitor your account.

- A TC15 is a chargeback—when a customer disputes a transaction with their bank.

- A TC40 is a fraud report—when a customer claims a transaction was unauthorized.

Even if your chargeback rate is low, a high number of fraud complaints (TC40s) can now put your MID at risk of termination.

Example: How Your VAMP Fraud Ratio Is Calculated

Sample Merchant Activity

TC40s (fraud complaints): 80

TC15s (chargebacks): 20

Total settled transactions: 4,500

Fraud Ratio Calculation

(80 TC40s + 20 TC15s) ÷ 4,500 transactions = 2.22% fraud ratio

Status: At Risk — Actively Monitored Under VAMP Since Oct 1 2025

Note: Most merchants see fraud ratios double when TC40s are included—even if chargebacks (TC15) remain low.

Why Every Merchant Should Be Concerned

Even if your business only receives a few hundred fraud alerts per month, you’re not automatically safe. Processors now evaluate fraud at the BIN level, and “hot” BINs—those with elevated fraud or dispute activity—can be flagged, throttled, or even shut down. Visa’s VAMP enforcement is now active as of October 2025, meaning acquirers are already reviewing portfolios for merchants exceeding 1.5% fraud ratios.

Here’s why this matters:

Acquiring banks must keep their entire portfolio fraud ratio under 0.30%.

If your MID has a fraud ratio above 0.30%—even if your chargebacks are low—you may be terminated to protect the BIN, well before Visa ever takes action.

Bottom line: It’s not just about staying under Visa’s thresholds anymore. You need to be low-risk for your processor, too.

Why Choose Our VAMP Tool?

Proactive Monitoring

Track chargeback rates and TC40 fraud in real-time across your entire portfolio with detailed alerts and risk indicators.

Multi-Layered Defense

Utilize Visa RDR, Ethoca, CDRN, and Order Insight to deflect and resolve disputes before they become chargebacks.

Seamless Integration

Connect effortlessly via API, SFTP, or direct processor link. Fast onboarding with minimal IT resources required.

Why Pre-Dispute Tools Aren’t Enough Under VAMP

Tools like RDR, CDRN, Ethoca, and Order Insight are often referred to as pre-dispute tools. They help resolve disputes before they become chargebacks by issuing quick refunds or sharing transaction details with the cardholder’s bank. These tools are incredibly useful for protecting your chargeback ratio—and you should absolutely be using them.

But here’s the problem:

They do nothing to prevent TC40 fraud reports. And under the new VAMP rules, TC40s count just as much as chargebacks in Visa’s fraud ratio calculation.

That means you could be doing everything right with pre-dispute resolution and still get flagged—or even terminated—if you’re not also preventing fraud complaints at the source.

How It Works

-

Risk Identification

Our tool continuously monitors transaction activity, dispute counts, and fraud signals to identify VAMP exposure early. -

Real-Time Defense

Deflect chargebacks in real-time using pre-dispute tools that prevent disputes from counting against your VAMP threshold. -

Transparent Reporting

Gain access to your VAMP score, mitigation progress, and dispute lifecycle analytics in one unified dashboard. -

Ongoing Optimization

Our tool evolves with Visa’s changing rules and thresholds to keep your business protected long-term.

Custom Pricing for Every Merchant

We offer flexible, customized pricing based on your volume, vertical, and risk profile. Whether you’re managing a few hundred disputes or thousands, we’ll tailor a solution that fits your needs.

Platform Access

Gain full access to a comprehensive dashboard with real-time analytics, monitoring tools, and actionable insights to help you stay ahead of chargebacks and fraud.

Dispute Deflection

Utilize advanced tools like Order Insight, Consumer Clarity, and CE3 to proactively deflect disputes before they become chargebacks.

Interception & Representment

Intercept disputes through trusted networks such as RDR, Ethoca, and CDRN. In the event of a chargeback, our expert representment services help maximize your chances of a successful recovery.

Get Started

"*" indicates required fields

Frequently Asked Questions

What is the VAMP program?

The Visa Acquirer Monitoring Program (VAMP) is Visa’s active fraud-monitoring framework that combines fraud reports (TC40s) and chargebacks (TC15s) into a single fraud ratio.

Enforcement began October 1 2025 at a 1.5% threshold, and Visa plans to tighten the limit to 0.9% on April 1 2026.

Merchants exceeding the active threshold risk reserves, throttling, or MID termination.

Are You at Risk?

If you answer yes to 2 or more, your account could be at risk:

- Are you using more than one MID?

- Are you selling digital goods or subscriptions?

- Do your customers often call their bank before contacting support?

- Do you get disputes where product/service was delivered?

How does this tool help me stay compliant?

It reduces disputes before they count against your score by using pre-dispute resolution services and flags risky activity in real-time.

Who should use this?

High-risk merchants, ISOs, PSPs, and acquirers looking to reduce dispute fines and improve fraud scores across their portfolios.

What are the fees per monthly count of fraud and disputes?

Visa has not published fixed per-dispute fees under VAMP. Instead, merchants exceeding thresholds may face portfolio review, reserves, or termination by their acquirer. The primary risk is losing processing ability—not individual dispute fees.

What to Expect on the Call

- No pressure sales

- 15-minute fraud risk review

- Get a real-time view of fraud signals Visa might already be tracking on you

- Understand exactly how your business could be impacted by VAMP

Email: [email protected]

Phone: +1 (516) 217-1989