5 Ways to Avoid Termination Under Visa’s New VAMP Guidelines

Visa’s updated Visa Acquirer Monitoring Program (VAMP) is raising the bar for compliance, especially for merchants operating in high-risk verticals. With tighter thresholds, faster enforcement, and less tolerance for repeat violations, non-compliance now carries serious consequences, including steep fines and account termination.

To help merchants navigate this evolving regulatory environment, here are 5 practical ways to stay compliant and avoid being shut down under the new VAMP guidelines:

1. Monitor and Reduce Your Chargeback Ratio Proactively

Under Visa’s previous VDMP program, the chargeback thresholds were:

- Early Warning: 0.65%

- Excessive Threshold: 0.9%

- Severe Violation Risk: 1.8%+

What to Do:

Use chargeback alert tools like Ethoca and Verifi to resolve disputes early.

Offer fast, no-questions-asked refunds to avoid chargebacks.

- Use chargeback alert tools like Ethoca and Verifi to resolve disputes early.

- Offer fast, no-questions-asked refunds to avoid chargebacks.

- Monitor daily chargeback trends and maintain internal KPIs below Visa’s limits.

2. Ensure Clear Billing Descriptors and Customer Recognition

A major source of chargebacks is unrecognized transactions. If a customer doesn’t recognize the charge, they’ll dispute it, even if it’s legitimate.

What to Do:

Use chargeback alert tools like Ethoca and Verifi to resolve disputes early.

Offer fast, no-questions-asked refunds to avoid chargebacks.

- Match your billing descriptor with your company or website name.

- Send confirmation emails after every purchase with clear contact info.

- Include a “what will appear on your statement” note on your checkout page.

3. Align All Customer-Facing Assets with Your Merchant Application

Visa’s new guidelines put pressure on acquirers to ensure merchant activities match what was approved during onboarding. A mismatch can be grounds for termination.

What to Do:

- Make sure your website, checkout pages, and ads reflect your approved merchant category code (MCC).

- Notify your processor before launching new products or funnels.

- Avoid deceptive, exaggerated, or non-compliant marketing claims.

4. Stay Ahead of Fraud with Real-Time Monitoring and Filters

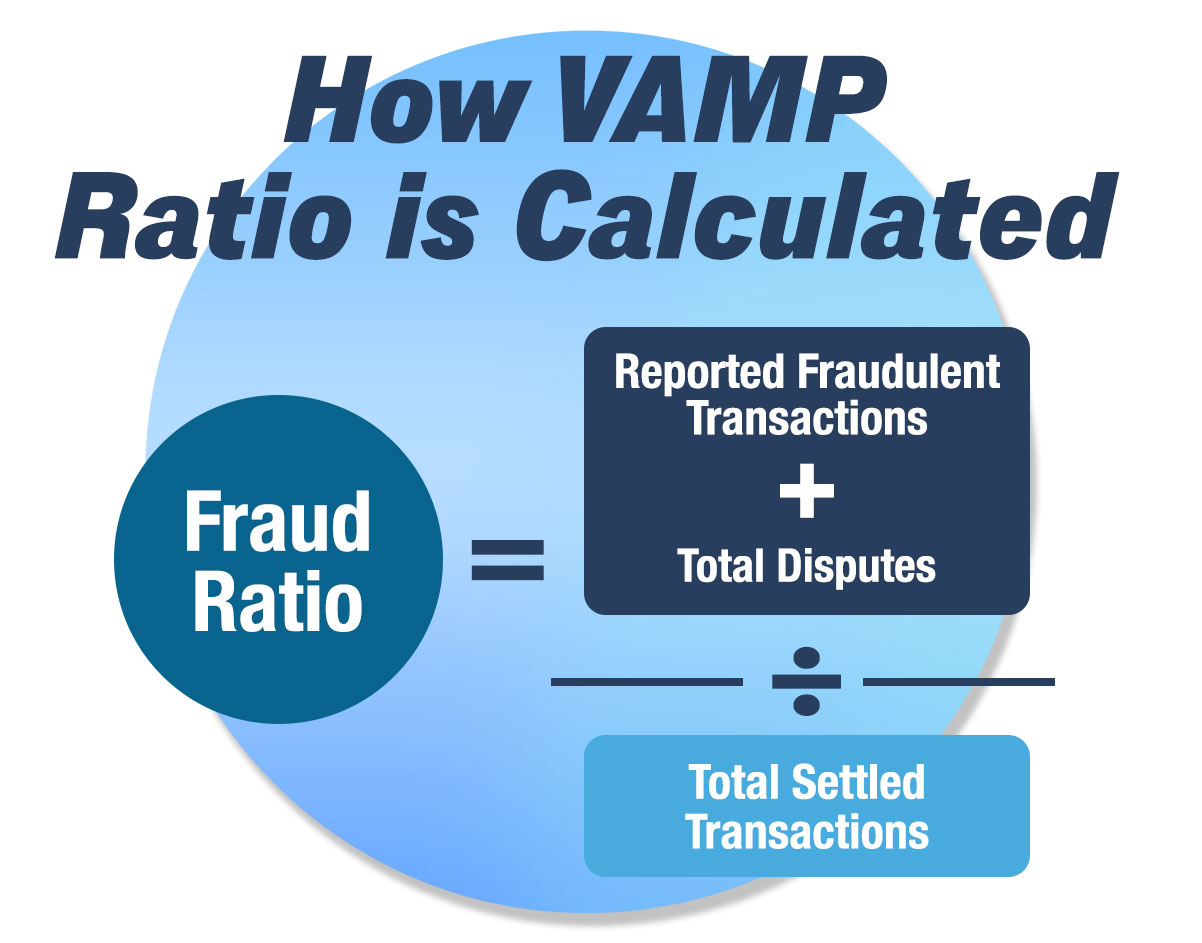

VAMP 2025 also targets fraud, and merchants flagged for excessive fraud-to-sales ratios will face enforcement. Visa now tracks confirmed fraud reports (TC40s) and chargebacks (TC15s). Acquirers may also monitor unusual fraud patterns that could lead to elevated ratios.

What to Do:

- Use fraud prevention tools like 3D Secure, Kount, or Sift.

- Set strict filters for geolocation, velocity, and BIN-blocking on suspicious traffic.

- Manually review high-ticket or international orders before approving.

5. Establish a Refund-First, Resolution-Driven Customer Service Culture

Visa is looking at how businesses handle disputes, not just whether they occur. Merchants that demonstrate proactive refund and customer care practices are less likely to face enforcement.

What to Do:

- Train your support team to prioritize refunds over letting disputes escalate.

- Respond quickly to support inquiries via email, chat, or phone.

- Document all interactions with customers to provide evidence if chargebacks occur.

- Remember: issuing a refund after a fraud complaint or chargeback won’t remove it from your fraud ratio. Preventing disputes before they happen is the only way to stay compliant under VAMP.

Final Thoughts

Visa’s new VAMP guidelines aren’t just about risk control — they’re a signal that card networks are demanding higher standards across the board. For high-risk and direct-response merchants, proactive compliance is now non-negotiable.

By monitoring your chargebacks, aligning your operations, enhancing customer service, and using the right fraud tools, you can safeguard your business and maintain healthy processing relationships.

If you’re uncertain about your current risk exposure, it may be time to audit your funnel, billing practices, and CRM, or contact PayDiverse and we can help you understand the nuances of high-risk merchant accounts. A single oversight today could cost you your merchant account tomorrow.

Diverse Payment Processing is Smart Processing

Fill out our free and quick merchant account application and let us match you with many banks that want your business.